Contents:

Nearly 70% of global logistics executives say they are bracing for recession amid higher costs, slowing demand, and ongoing supply chain disruption arising from China’s battle to contain COVID, Russia’s war in Ukraine, and the impact of climate change. The index is derived from the FTSE Global Equity Index Series , which covers 99% of the world’s investable market capitalisation. The series includes large and mid cap securities from advanced and secondary emerging markets, classified in accordance with FTSE Russell’s transparent Country Classification Review Process. U.S. investors who want to buy into global stocks can buy shares of an exchange-traded fund that mirrors the index.

Business Involvement metrics are designed only to identify companies where MSCI has conducted research and identified as having involvement in the covered activity. As a result, it is possible there is additional involvement in these covered activities where MSCI does not have coverage. This information should not be used to produce comprehensive lists of companies without involvement.

- The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401 plans or individual retirement accounts.

- This and other information can be found in the Funds‘ prospectuses or, if available, the summary prospectuses which may be obtained by visiting the iShares ETF and BlackRock Mutual Fund prospectus pages.

- Intraday data delayed at least 15 minutes or per exchange requirements.

- IG International Limited receives services from other members of the IG Group including IG Markets Limited.

Shows the constituent stocks that have fallen in price the most over the last 24 hours, based on the percentage change since the last close of trading. Shows the constituent stocks that have risen in price the most over the last 24 hours, based on the percentage change since the last close of trading. MSCI later today will announce an increase in the weighting of mainland China in its MSCI Emerging Markets Index , a benchmark used by many global funds and ETFs, including the iShares MSCI Emerging markets ETF , acco… After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown.

The MSCI World Marks Index tracks the performance of large-cap and mid-cap stocks in 23 developed nations in North America, Western Europe, and the Asia-Pacific region. The countries and the stocks in the index change from time to time. As of the end of 2021, they include Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey, and the United Arab Emirates.

Trading indices with IG

Collectively, their performance from day to day suggests the overall direction of a market. There also are funds that do not mirror the MSCI Emerging Markets Index but use it as a benchmark against which to measure their own performance. These include Avantis Emerging Markets Equity ETF , Innovator MSCI Emerging Markets Power Buffer ETF January Series , and Innovator MSCI Emerging Markets Power Buffer ETF July Series . For example, the iShares MSCI Emerging Markets Index ETF invests at least 80% of its assets in stocks and American depositary receipts included in the index.

ADRs End Mostly Lower; Eletrobras Edges Down After Hydroelectric Plant Deal – MarketWatch

ADRs End Mostly Lower; Eletrobras Edges Down After Hydroelectric Plant Deal.

Posted: Fri, 14 Apr 2023 22:05:00 GMT [source]

Index providers comprise a handful of large, for-profit firms including FTSE Russell, MSCI, S&P Dow Jones, and Bloomberg. Within emerging market equities, the two dominant indices are the MSCI Emerging Markets Index and the FTSE Emerging Markets All Cap China A Inclusion Index. Business Involvement metrics are calculated by BlackRock using data from MSCI ESG Research which provides a profile of each company’s specific business involvement. BlackRock leverages this data to provide a summed up view across holdings and translates it to a fund’s market value exposure to the listed Business Involvement areas above. The MSCI Emerging Markets index is arguably the most recognisable emerging market index among investors. Less recognisable, however, is the makeup of the index over time.

Management oversight is provided by the Global Head of Index Funds. The team has average industry experience of 15 years, of which seven years has been at LGIM, and is focused on achieving the equally important objectives of close tracking and maximising returns. Some critics of commercial indices express doubt over the ability of a few, for-profit index providers to effectively represent and safeguard the market’s interests. Emerging market index providers’ pursuit of scalability and replicability has taken precedence over fidelity to the fundamentals of the underlying markets.

Why global investors can’t ignore Turkey’s latest currency woes

These objectives include https://forex-world.net/ representation, cost efficient and rapid replication, and sometimes pressure to represent “acceptable investment standards” to government officials internationally. What may be sidelined is an accurate picture that fairly represents the known and less-trafficked segments of the emerging markets. The emerging markets bond index is a benchmark index for measuring the total return performance of international government bonds by emerging markets.

Fragmenting Foreign Direct Investment Hits Emerging Economies … – International Monetary Fund

Fragmenting Foreign Direct Investment Hits Emerging Economies ….

Posted: Wed, 05 Apr 2023 07:00:00 GMT [source]

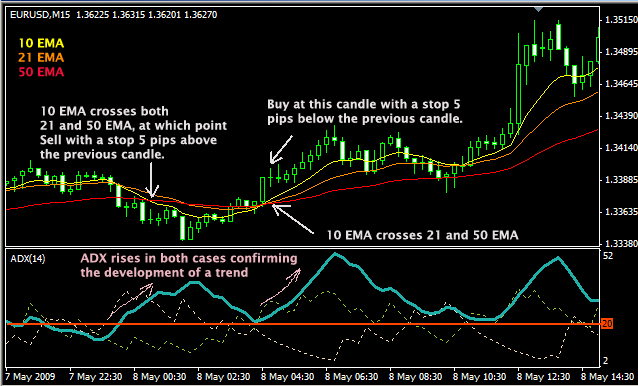

Emerging market index 100 from 4 points and more 24-hour markets than anywhere else. This is a visual representation of the price action in the market, over a certain period of time. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Market Cap

Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. The MSCI Emerging Markets Index is a selection of stocks that is designed to track the financial performance of key companies in fast-growing nations. It is one of a number of indexes created by MSCI Inc., formerly Morgan Stanley Capital International. Any trading or investment decisions taken by you should be based on your own analysis and judgment (and/or that of your professional advisers) and not in reliance on us or the Information. Colin Post, “Ruling signals MSCI likely to keep Peru as ‘emerging market’,” Peru Reports, 12 May 2016.

AQR: Emerging Market Stocks Have Best Return Profile in 20 Years – Institutional Investor

AQR: Emerging Market Stocks Have Best Return Profile in 20 Years.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

MSCI has a number of indexes that track global stocks, including the MSCI World Index, which tracks the stocks of developed nations, and the MSCI All-Country World Index, which tracks a broad selection of stocks across both developed and emerging nations. Full BioCierra Murry is an expert in banking, credit cards, investing, loans, mortgages, and real estate. She is a banking consultant, loan signing agent, and arbitrator with more than 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management. Two prominent definitions of the EM asset class are advanced by two index providers, MSCI and FTSE/Russell. Both firms undertake periodic reviews, during which they determine (and as necessary, re-classify) the constituent national members of their respective EM indices that are designed to track the asset class. MSCI’s latest determination, as of March 2019, includes 26 nations; FTSE/Russell’s latest determination, also as of March 2019, includes 24 nations, with some determinations that differ from MSCI.

Pricing & Exchange

The after-tax returns shown are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401 plans or individual retirement accounts. For newly launched funds, Sustainability Characteristics are typically available 6 months after launch. The MSCI All Country World Index is a stock index designed to provide a broad measure of global equity market performance. Less than 12% of the index was comprised of the stocks in emerging market nations, More than half of the index is made up of U.S. companies.

Achieving such exceptional returns involves the risk of volatility and investors should not expect that such results will be repeated. Negative weightings may result from specific circumstances and/or the use of certain financial instruments, including derivatives, which may be used to gain or reduce market exposure and/or risk management. For more information regarding a fund’s investment strategy, please see the fund’s prospectus. Business Involvement metrics can help investors gain a more comprehensive view of specific activities in which a fund may be exposed through its investments. The performance quoted represents past performance and does not guarantee future results.

The Information has not been submitted to, nor received approval from, the US SEC or any other regulatory body. Some funds may be based on or linked to MSCI indexes, and MSCI may be compensated based on the fund’s assets under management or other measures. MSCI has established an information barrier between equity index research and certain Information. None of the Information in and of itself can be used to determine which securities to buy or sell or when to buy or sell them. The Information is provided “as is” and the user of the Information assumes the entire risk of any use it may make or permit to be made of the Information.

- Like the Dow Jones Industrial Average, the MSCI Emerging Markets Index is a selection of stocks.

- Currency hedging techniques may be applied to reduce this impact but may not entirely eliminate it.

- The information contained on this website is published in good faith but no representation or warranty, express or implied, is made by BlackRock or by any person as to its accuracy or completeness and it should not be relied on as such.

- There are of course many more EM benchmarks in the market, but the MSCI Emerging Markets Index is the most widely used with over 1.84 trillion USD-equivalent of benchmarked AUM.18 Figure 2 compares the normative MSCI EM Index with a positive EM benchmark, assembled by Seafarer.

Invests in shares of companies from developing countries, classified according to the Index provider’s methodology. As of 31 December 2019, the MSCI Emerging Markets Investable Market Index had 3,057 constituents, a median market cap of USD 1,850 million, and an average market cap of USD 7,608 million. In Part II of A Tale of Two Indices, we continue our discussion in quantitative terms, by making comparisons of the normative and positive indices along key investment facets. What this means for benchmarking investors is that the “active” portfolio decisions of country inclusion and weighting are made by index providers. To accomplish this, we will first need to introduce terminology that frames alternative approaches to measuring markets. Establishing clear definitions will help us to understand the sometimes diverging expectations market participants have of their benchmarks, and contextualize the choices by index providers to either accept or reject these expectations.

Neither MSCI ESG Research nor any Information Party makes any representations or express or implied warranties , nor shall they incur liability for any errors or omissions in the Information, or for any damages related thereto. The foregoing shall not exclude or limit any liability that may not by applicable law be excluded or limited. The Dow Jones Emerging Markets Index is designed to measure 95% of the market capitalization coverage of stocks traded in emerging markets. Following the imposition of sanctions on Russian securities and assets being removed from indices the market has been effectively frozen for foreign investors and all equity positions have been marked to zero in line with LGIM’s fair value pricing policy. Regardless of being priced at zero LGIM funds may still own these securities and any value realised in the future will be for the sole benefit of the relevant fund.

Why ETFs Experience Limit Up/Down Protections

Get in-depth knowledge on the European ETF market by subscribing to all our newsletters that deliver expert analysis, market insights and industry events. The MSCI Emerging Markets index is one of the most dynamic indices, so investors should frequently look under the hood to see what they are really buying. Elsewhere, the Vanguard FTSE Emerging Markets UCITS ETF has proven popular with investors having gathered $2.7bn assets since launch in May 2012. This information is only directed at investors resident in jurisdictions where each fund is registered for sale. It is not an offer or invitation to persons outside of those jurisdictions. We reserve the right to reject any applications from outside of such jurisdictions.

This list includes investable products traded on certain exchanges currently linked to this selection of indices. While we have tried to include all such products, we do not guarantee the completeness or accuracy of such lists. Please refer to the disclaimers here for more information about S&P Dow Jones Indices‘ relationship to such third party product offerings.

The figures shown for market capitalisation may not be comparable between funds as they can be measured and classed in different ways. The two EM indices’ methodology documents point to a hybrid approach on the normative-positive spectrum. Both indices start with objective market capitalization data, then layer on subjective free float estimates and normative screens for what an index “should” look like, and ultimately rely on teams to handle trickier aspects of index implementation and rule changes. As a positive index based on market capitalization does not filter for current trading constraints or estimates of float, it directly reflects where capital markets have recognized value creation.

Please read this page before proceeding, as it explains certain restrictions imposed by law on the distribution of this information and the countries in which our funds are authorized for sale. It is your responsibility to be aware of and to observe all applicable laws and regulations of any relevant jurisdiction. On this website, financial intermediaries are investors that qualify as institutional investors, qualified investor, or professional investors in their respective jurisdiction of residence , acting as agents on behalf of non-U.S. Access exclusive data and research, personalize your experience, and sign up to receive email updates.

Business Of Sports If the only thing you know about sports is who wins and who loses, you are missing the highest stakes action of all. The business owners that power this multibillion dollar industry are changing, and a new era of the business of sports is underway. From media and technology to finance and real estate, leagues and teams across the globe have matured into far more than just back page entertainment. And the decisions they make have huge consequences, not just for the bottom line, but for communities, cities, even entire countries. License Nasdaq’s full range of global equity, commodity or fixed income indexes.